TOKYO – 25 JANUARY 2010 – Numerical Technologies, a leading provider of financial risk management software, announced today the release of PortfolioBrowser® version 1.9.0. PortfolioBrowser® is a risk management system that calculates integrated VaR and the correlation effect among market risk and credit risk factors.

PortfolioBrowser® 1.9.0 allows clients to:

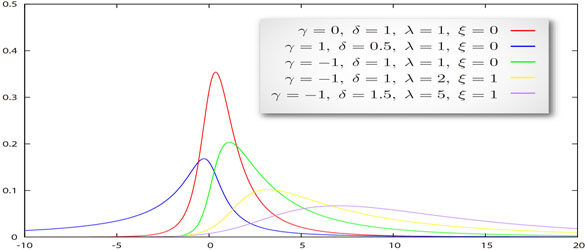

- Use fat-tail probability distribution when calculation VaR using the Monte Carlo and variance-covariance methods

- Observe non-normal probability characteristic parameters from time series of risk factors

- Generate Johnson SU or Pareto-Gaussian mixed-distribution-based scenarios, and simulate more realistic fat-tail effects

About Numerical Technologies

Numerical Technologies is a leading financial risk management software company that specializes in high-performance computing (HPC), parallel Monte Carlo simulation, and financial modeling.