SINGAPORE – 23 MARCH 2012 – Numerical Technologies today announced the latest release of NtInsight® for Market and Credit Risk, a financial risk management software that helps banks and insurance firms measure and manage integrated value-at-risk (VaR), and comply with the Basel III capital requirement. The updated NtInsight® for Market and Credit Risk offers risk managers greater control, precision, and transparency over their data and the VaR calculation process.

Key Features

- Enhanced Monte Carlo Simulation – risk managers now have the ability to create risk factor scenarios outside of the NtInsight® system and use these to override some or all of the scenarios generated through NtInsight®. This gives risk managers unparalleled control over their stress test data combinations and preconditions when calculating VaR through the Monte Carlo simulation method.

- Enhanced Profit/Loss Aggregation – the latest NtInsight® for Market and Credit Risk supports mixed-method profit/loss aggregation. With this feature, risk managers can specify a different accounting rule—either historical cost or mark-to-market—for each contract in the portfolio. VaRs calculated in this mode provide more precise approximation of actual financial accounting P&L.

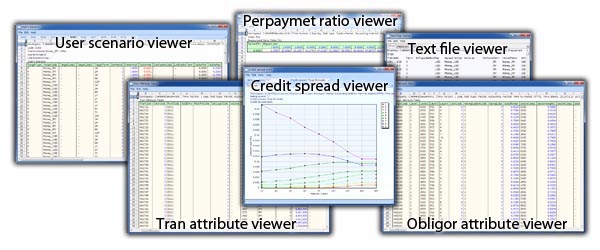

- Enhanced Access to Input Data and Conditions – the enhanced user interface allows risk managers to view their input data from within the NtInsight® system. In addition, fundamental calculation conditions, such as the accounting method used, are now available on all output worksheets. The enhanced interface increases access to information, promotes a more transparent risk calculation process, and eases validation.