14 AUGUST 2015 – Numerical Technologies provides both database and software solution to support the key requirements presented by the Basel Committee on Banking Supervision (BCBS) in its consultative document on the principles for effective risk data aggregation and risk reporting (known as BCBS239). The BCBS demands that the information which banks use to drive decision-making should capture all risks with appropriate accuracy and timeliness. Two main challenges for the implementation of BCBS239 are the risk data aggregation and the accuracy and comprehensiveness of risk reporting.

Numerical Data Model™, designed specifically for financial risk management, provides service for the Enterprise Risk Management (“ERM”) data mart. NtInsight® for Credit Risk, NtInsight® for Market Risk, NtInsight® for ALM, and NtInsight® for Operational Risk, serving as calculation engines, support the generation of risk information for reporting purposes and have the features to meet the requirements as stated in BCBS239.

NtInsight® Features for Risk Data Aggregation

| No | BCBS239 Requirements | NtInsight® Features |

|---|---|---|

| 1 | A bank should be able to generate accurate and reliable risk data. | Numerical Data Model™ supports the design, development, and maintenance of ERM data mart, and helps aggregate input data on a largely automated and accurate basis. |

| 2 | A bank should be able to capture and aggregate all material risk data across the banking group. | Numerical Data Model™ can achieve high coverage of risk data. NtInsight® calculates various risk indicators such as marginal risks and component VaR. |

| 3 | A bank should be able to generate aggregate and up-to-date risk data in a timely manner while also meeting the principles relating to accuracy and integrity, completeness and adaptability. | Numerical Data Model™ gives risk managers high efficiency to aggregate risk data rapidly. |

| 4 | A bank should be able to generate aggregate risk data to meet a broad range of on-demand, ad hoc risk management reporting requests. | NtInsight® supports user-defined setting to meet changing internal needs and reporting requests. |

Numerical Data Model™

Numerical Technologies supports financial institutions in the development of data mart for financial risk management. Based on our track record of working with major financial institutions, we have developed a database system which is required for Enterprise Risk Management. Numerical Data Model™ specializes in financial risk management and achieves high coverage and efficiency of risk data. When financial institutions create a data mart for ERM, we provide the following services using Numerical Data Model™:

- Data mart design support

- Data mart development and maintenance support

- Development and maintenance of ETL tool to transfer data to NtInsight®

NtInsight® Features for Risk Reporting Practices

| No | BCBS239 Requirements | NtInsight® Features |

|---|---|---|

| 1 | Risk management reports should accurately and precisely convey aggregated risk data and reflect risk in an exact manner. Reports should be reconciled and validated. | NtInsight® has analytical tools to check the validity of each scenario and simulation, and the user can trace the result by breaking down into a transaction or obligor level. |

| 2 | Reports should cover all material risk areas within the organization. | NtInsight® enables users to analyze the entire portfolio’s risk profile as well as the risk distributed by different groupings. |

| 3 | Reports should communicate information in a clear and concise manner, and should be easy to understand yet comprehensive enough to facilitate informed decision-making. Reports should include meaningful information tailored to the needs of the recipients. | NtInsight® provides multiple analytic tools to make calculation results easy to understand. Details of each simulation scenario are provided to ensure transparency and clarity. |

| 4 | The board and senior management (or other recipients as appropriate) should set the frequency of risk management report production and distribution. The frequency of reports should be increased during times of stress/crisis. | NtInsight® creates text file output that the user can use as input to a BI tool that helps the user create graphic risk reports easily and quickly. |

| 5 | Reports should be distributed to the relevant parties while ensuring confidentiality is maintained. | By using the BI tool connected to NtInsight® , risk managers can select the information that should be included in the distribution report. |

Summary of the Consultative Document – BCBS239, Principles for Effective Risk Data Aggregation and Risk Reporting

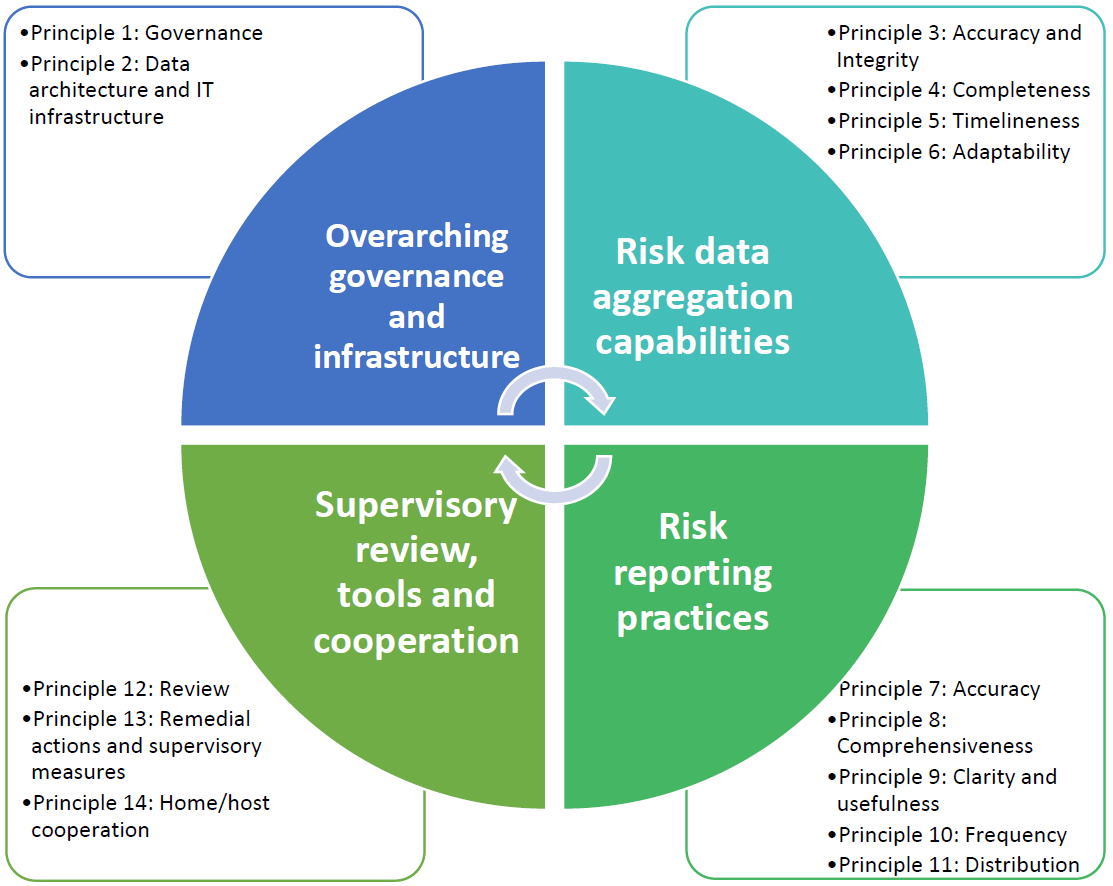

The deadline for G-SIBs to meet these expectations should be the beginning of 2016. National supervisors also apply these Principles to banks identified as D-SIBs (domestic systemically important banks) by their national supervisors three years after their designation as D-SIBs. For the purpose of strengthening a bank’s risk data aggregation and reporting processes, the principles cover four closely related topics: Overarching governance and infrastructure, Risk data aggregation capabilities, Risk reporting practices, and Supervisory review, tools and cooperation. The summary categorized by each topic is listed in the table as below: