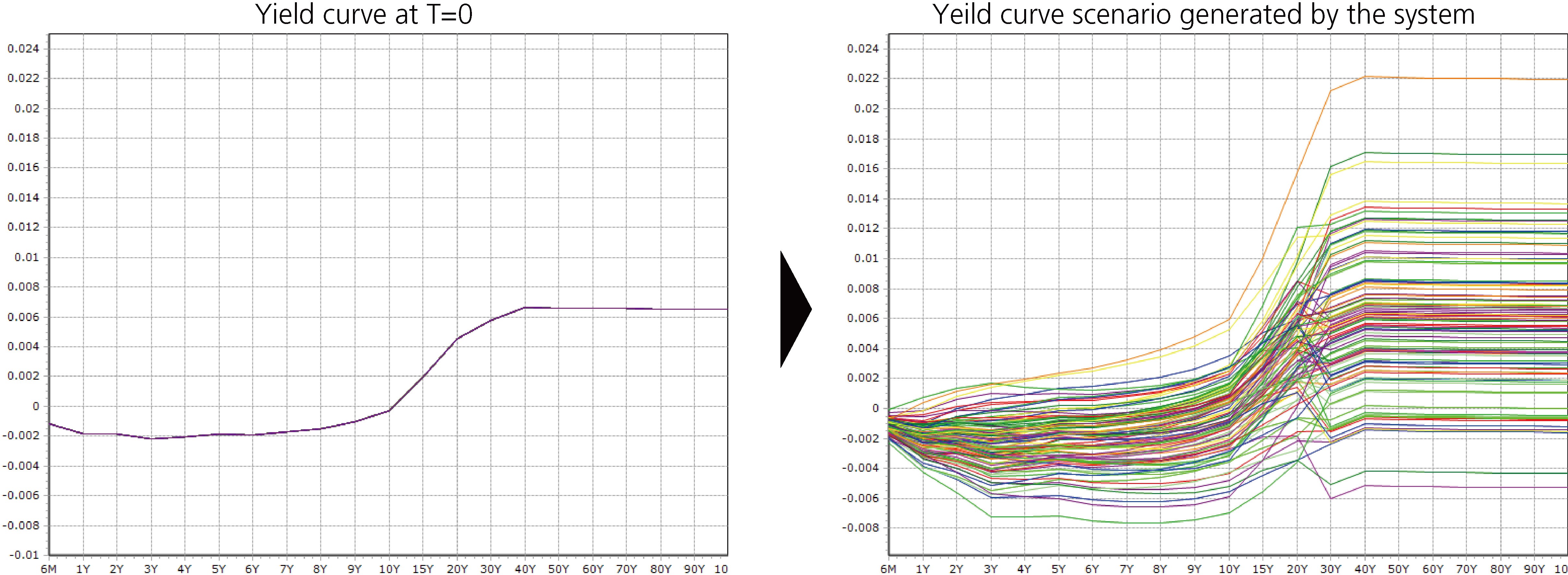

21 SEPTEMBER 2016 – The Bank of Japan overhauled its monetary policy framework by abandoning its base money target on September 21. Instead, yield curve control will be placed as the core of the new framework, with long-term rate kept around 0% and short rate maintained at negative 0.1%. To help financial institutions cope with the policy and corresponding regulations, the latest version of NtInsight® now supports negative interest rates in both stress test and Monte Carlo simulation.

Updated methodology

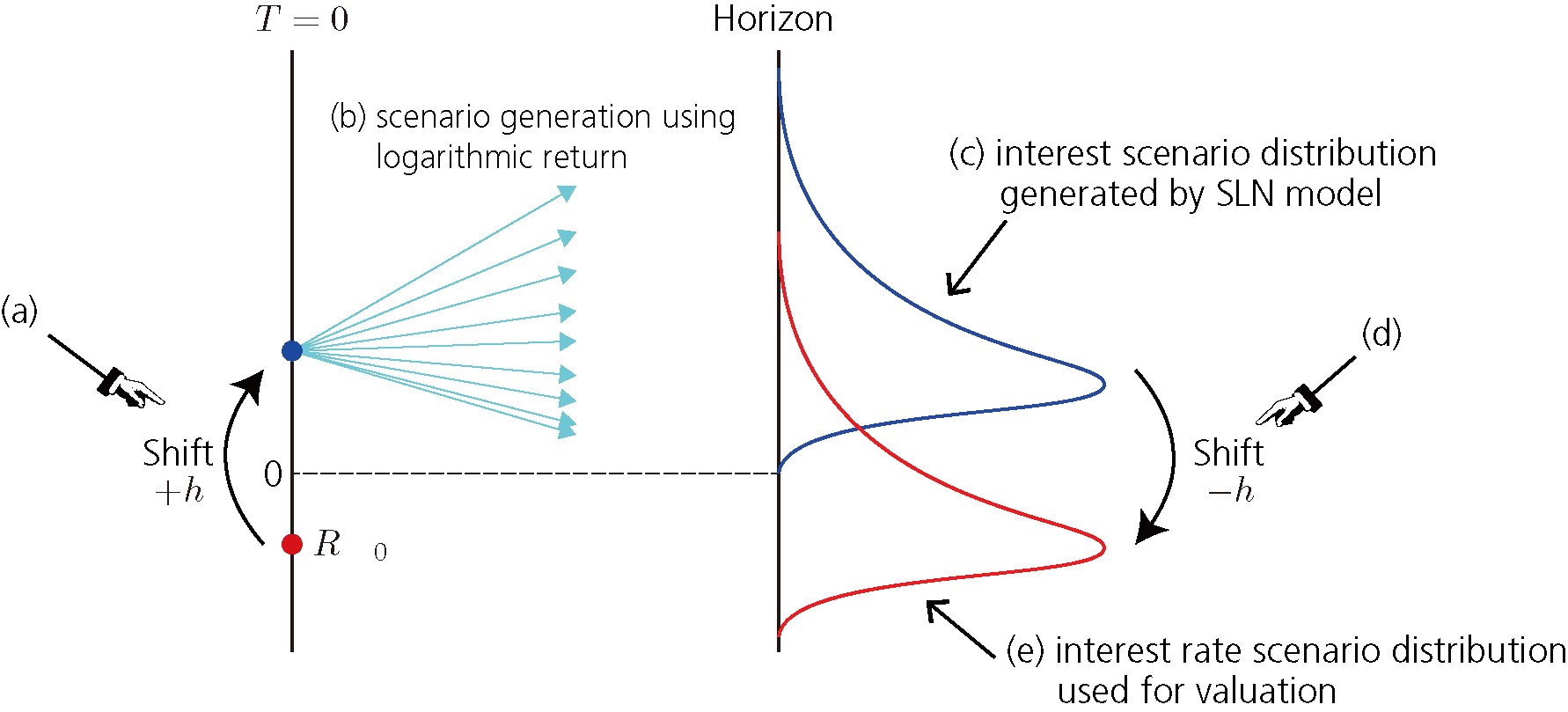

Negative interest rate in term structure was made available first to cater for scenario setting in stress testing. In addition, with the implementation of Shifted Log-Normal model (i.e., SLN model), yield curve scenarios with negative interest rate could be generated for simulation and evaluation.

For more details, please refer to this white paper.